About

How might replace the old and cluttered software used for the daily back-office operations of a financial institution, as well as, allow the institutions’ clients to monitor their investments and perform transactions.

The Client

NN Hellas, Metlife Greece, Allianz Hellas

Solutions

A web portal that, depending on the user that is logged in, serves both as a tool for employees of financial institutions to provide better service to their customers, and as a dashboard for monitoring and performing transactions for the end-user.

An admin module that serves as the backend of the portal allowing for administrative work such as activating users, scheduling jobs, managing products, etc

A website used to provide information about the company’s services and investment strategies to potential clients.

Functional Analysis

Context Diagram

One of the basic principles of requirements gathering and analysis is designing a Context Diagram, where the system is displayed surrounded by a set of ‘actors’.

This helped us define the system’s scope, effectively communicate the system’s requirements to stakeholders and identify potential issues early in the development process, such as data flow or security concerns.

Sitemap

Flowcharts and Diagrams

Working closely with the development team, we created flowcharts and diagrams outlining the order process for different transaction types.

Some of the most important ones proved to be the UML Class Diagrams which helped us ensure that the system is well-designed, well-understood and well-communicated among all stakeholders. Also by modelling the system’s behaviour, including the methods and interactions of the classes and objects, it served as a reference for the implementation and maintenance of the system.

In the following sample diagram, the specific names of classes and their states have been redacted for privacy and security reasons.

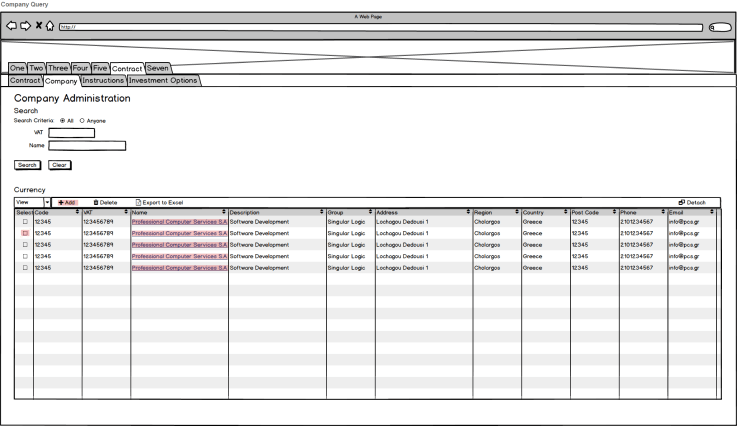

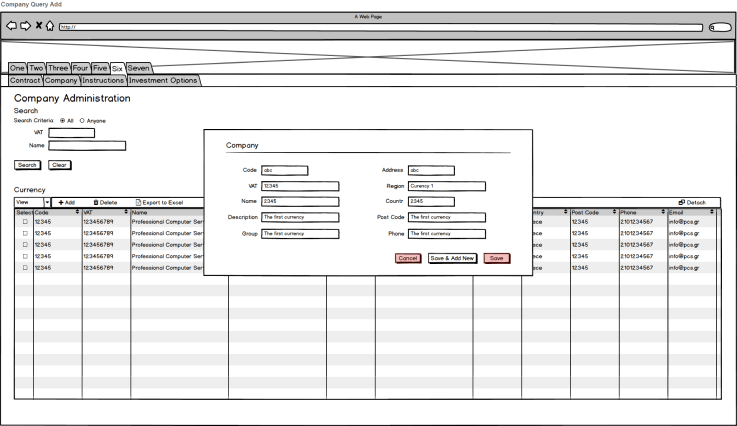

LO-FI Prototypes

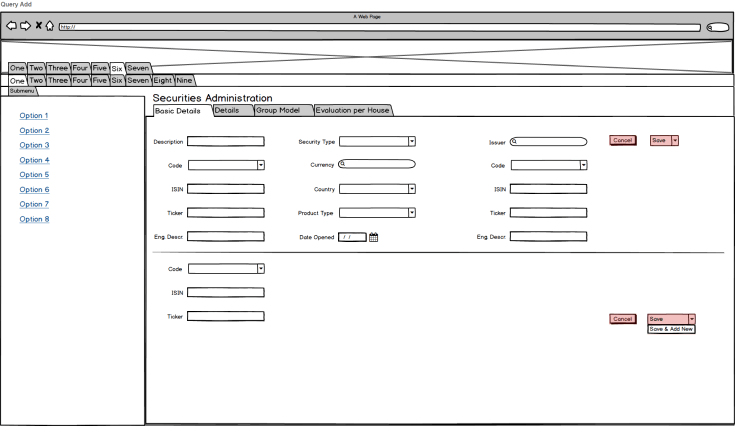

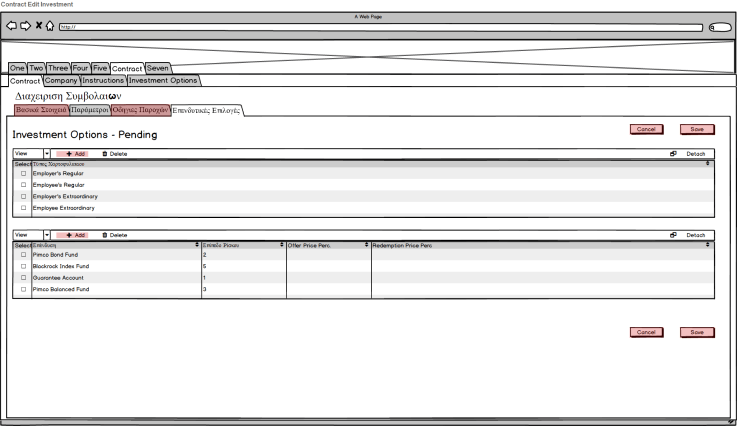

Wireframes

Once the requirements were agreed upon, the initial, low-level sketches could be produced and were used in the first ideation sessions and design sprints together with the development team.

With the functionality traced and explained, and the development team aligned, we were able to start producing prototypes. After gathering all the ideas that we had produced in the early meetings, I was able to create wireframes which served as a useful tool for the development team, as they provided a clear overview of the system’s structure and functionality. This allowed us to advance to developing components of the solution without the need for pixel-perfect mockups.

Hi-Fi Prototypes

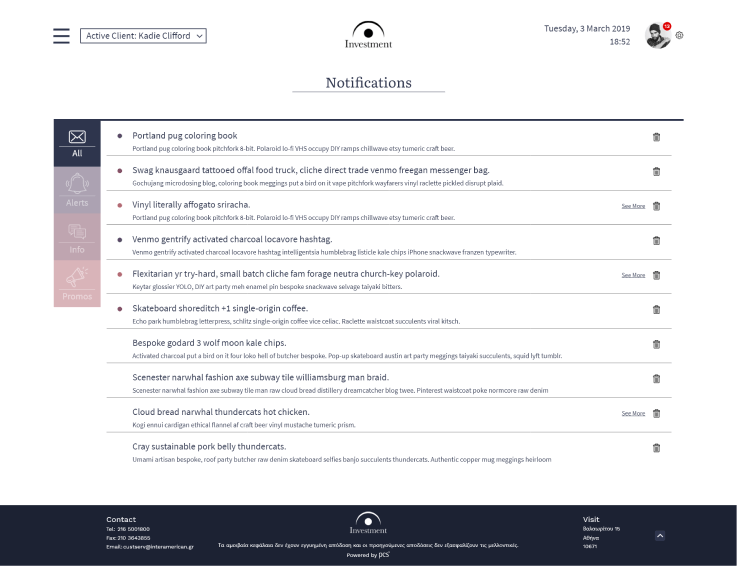

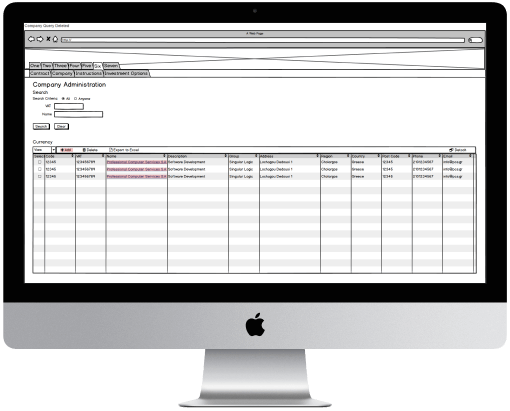

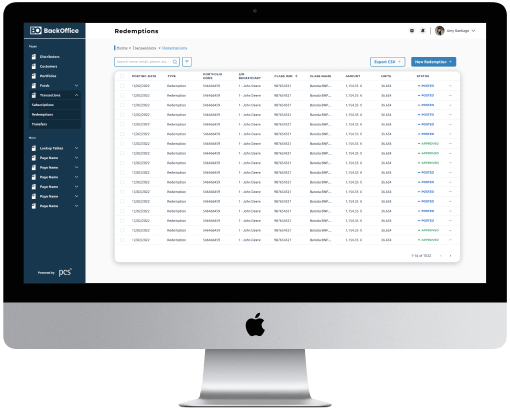

Admin Console

The first component of our solution is a back-office admin console that allows the administrators to manage and oversee the portal’s operations.

The console allows administrators to manage user accounts, monitor transactions and performance, and configure system settings. It also provides reporting and analytics capabilities, allowing administrators to track and analyze data such as user activity and performance. The console can also be used to manage compliance and security, and troubleshoot any issues that may arise.

Overall, it provides the necessary tools to ensure the smooth and efficient running of the wealth management platform.

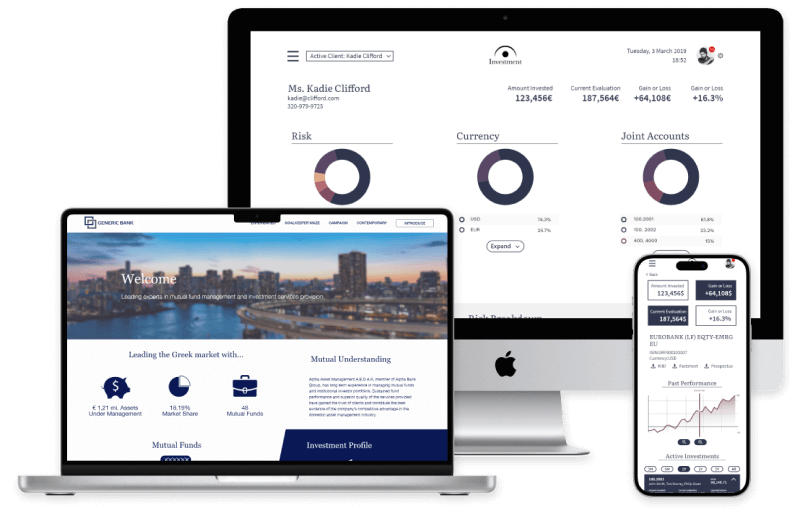

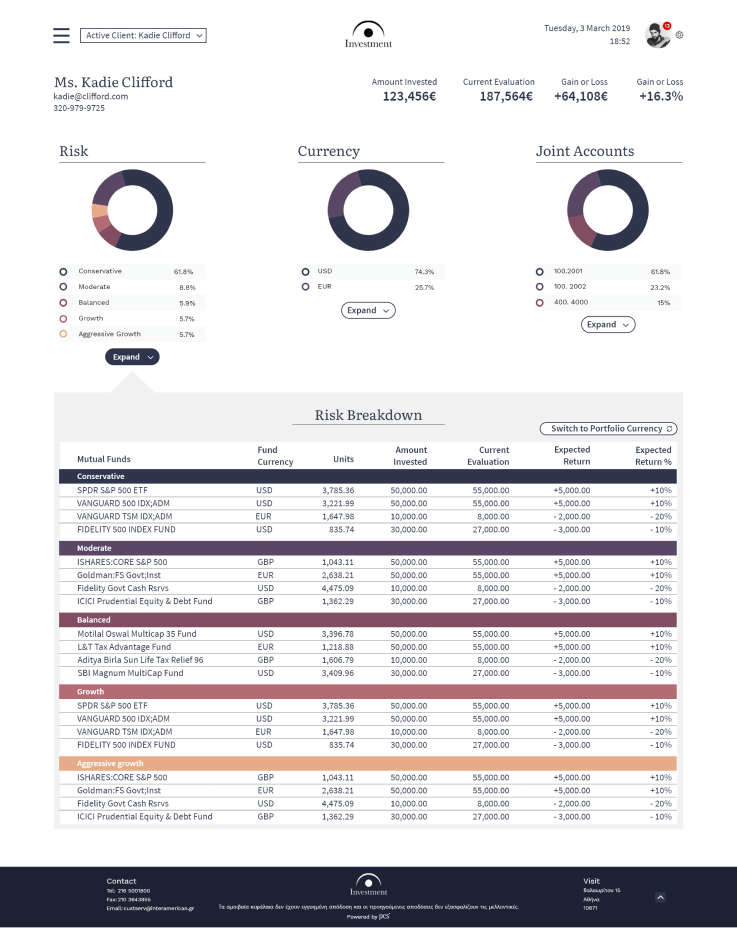

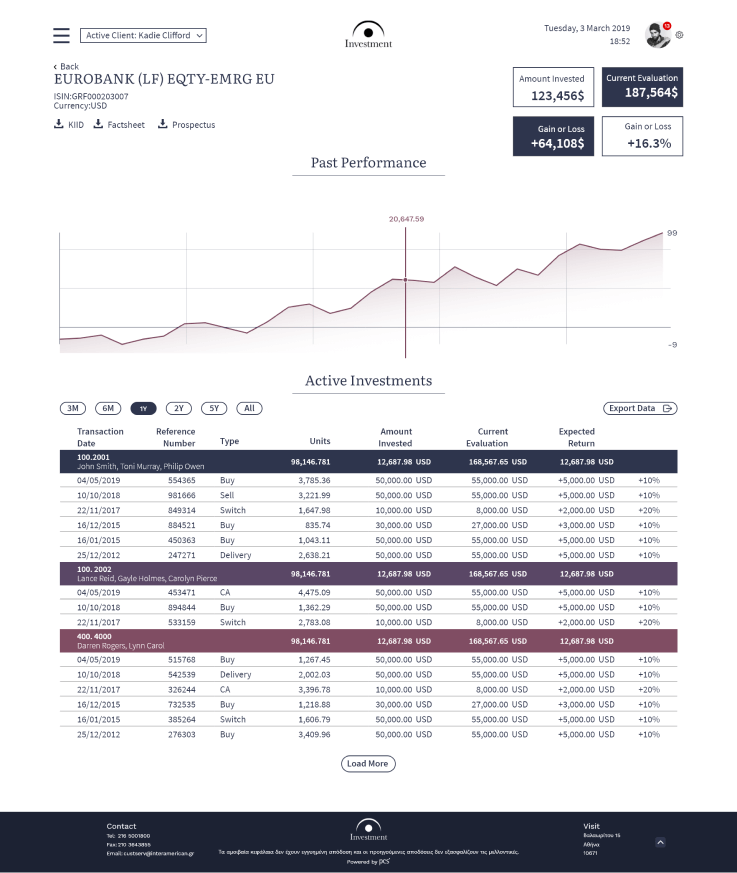

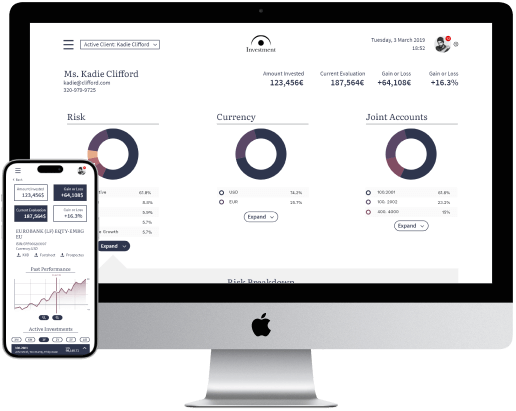

Web Portal

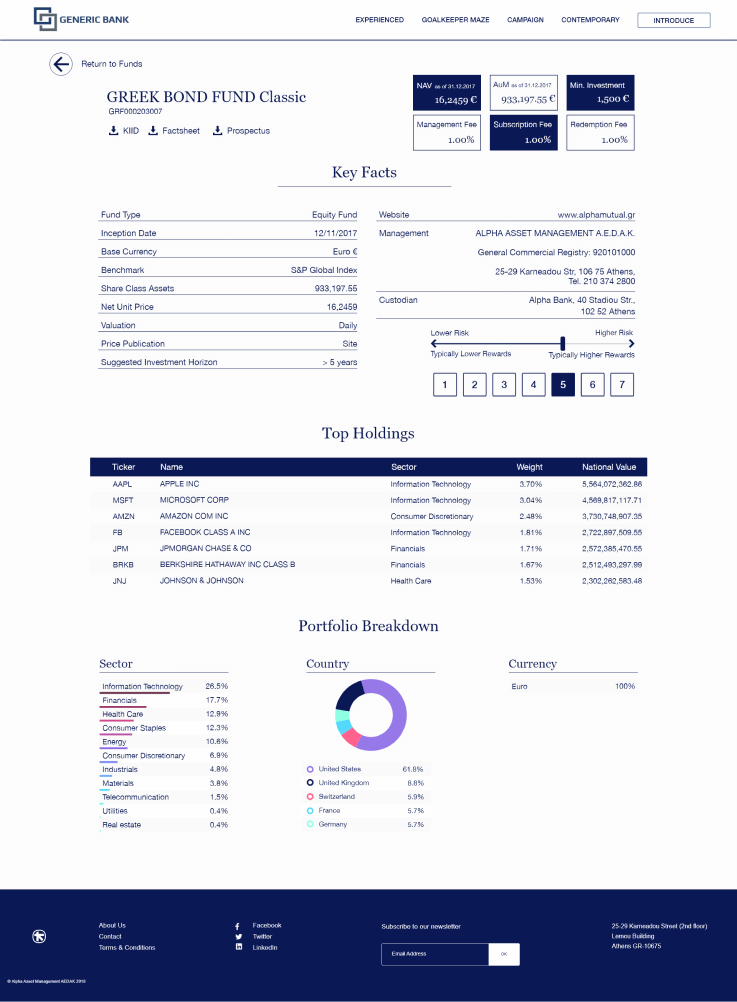

In addition to the admin console, we delivered a user-facing website that allows clients to access their investment portfolio, account information, and financial data.

The portal enables clients to view their account balances, performance, and transaction history, and also allows them to make trades and manage their portfolio. The portal also provides personalized financial advice, market research, and other financial tools to help clients make informed decisions about their investments. Additionally, it allows clients to securely communicate with their financial advisor and access other related services.

Overall, the front-end web portal provides clients with a convenient and secure way to manage their wealth and investments.

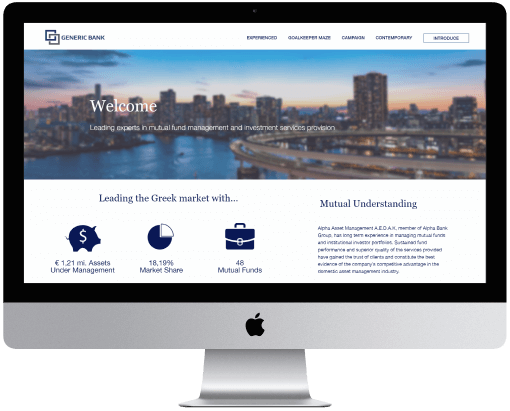

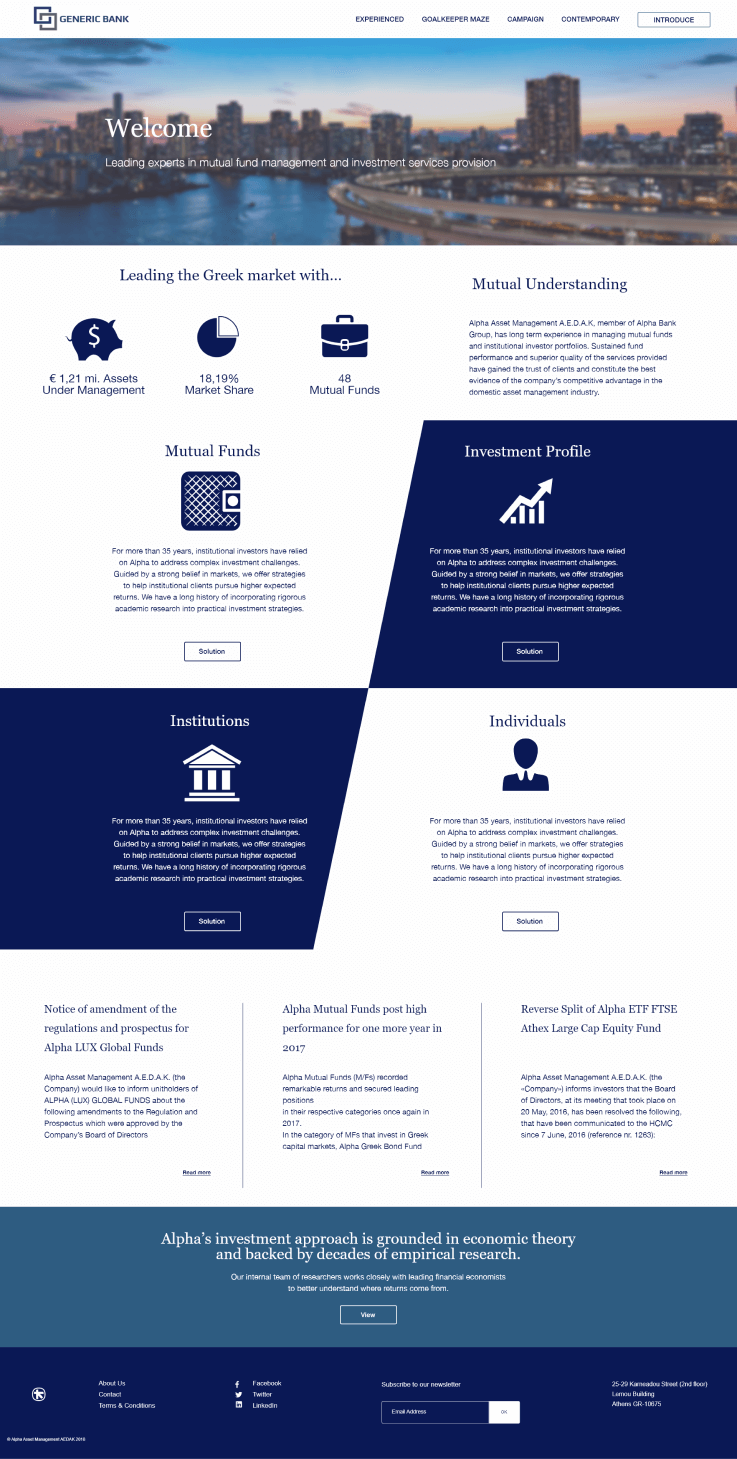

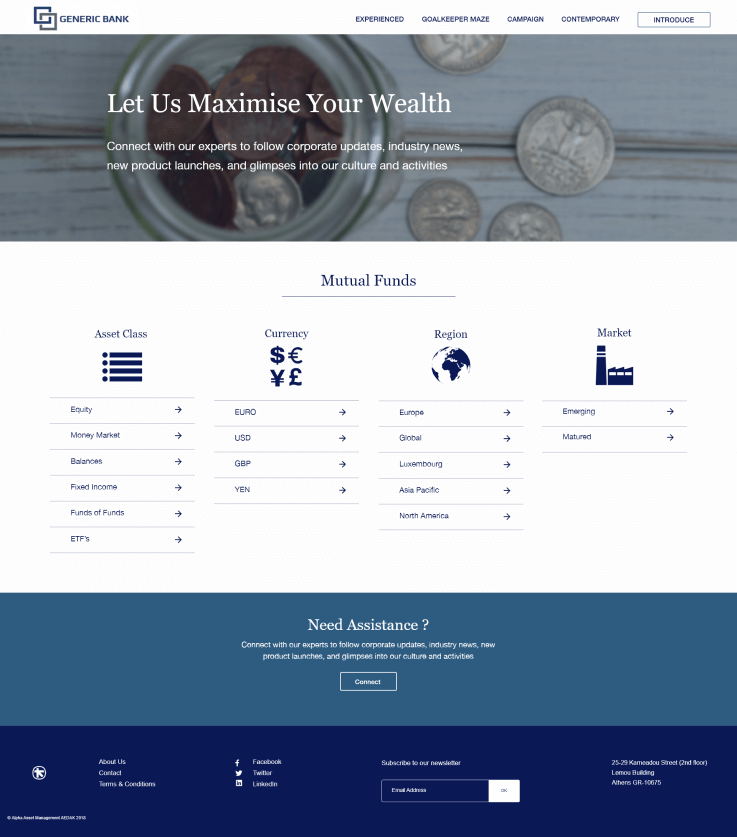

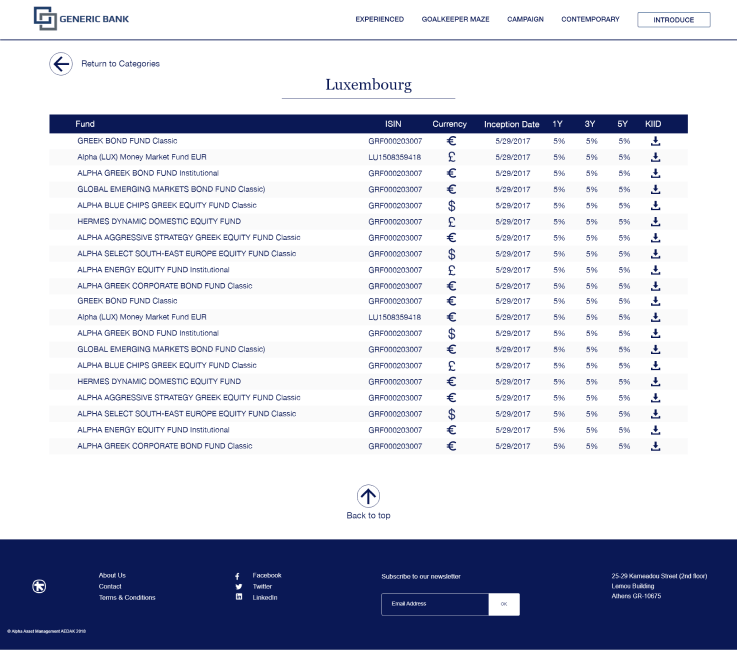

Website

The final component of our solution was a website that serves as a platform for potential clients to learn about the company’s services, investment strategies and performance.

It includes information about the company’s team, the investment process and the different services that the company offers. It also provides a way for potential clients to contact the company for further information, schedule a consultation or open an account. It also includes a login portal for existing clients to access their account information, access to educational resources and financial tools.

Overall, the website serves as a primary point of contact and a source of information for clients and potential clients of the wealth management company.